7 Best PayPal Alternatives in Australia

Are you on the hunt for PayPal alternatives Australia businesses can count on for all their payment processing needs?

Then this post is for you!

While PayPal is a household name throughout the globe, it is a source of frustration for many. Business owners struggle with high fees and poor customer support. Sometimes, the biggest name in the industry isn’t always the best.

In this post, we want to help you find the best PayPal alternatives to suit your specific needs. We’ll look at:

- The top reasons to switch from PayPal

- The story of one business that saved tons of money by finding a PayPal alternative

- The 7 best alternatives to PayPal in Australia

When it comes to payment processing, Paypal is the biggest name in the market. Its goodwill is unbeatable. However, Paypal charges a high processing fee. – Volopay

Contents:

- Is There a Better Payment System Than PayPal?

- What Online Payment System Is Best?

- Stripe

- Square

- eWay

- SecurePay

- Braintree

- Afterpay

- Zip Pay

Why Find An Alternative To PayPal?

You probably already have some of your own reasons for considering a PayPal alternative. Can you relate to some or all of these issues that other business owners have encountered?

Poor Customer Service

At the time of writing this post, PayPal has a 1.3 out of 5 rating on Trustpilot. 86% of their 22,000+ reviews are 1-star, and when filtered for the tag “customer service”, there are 100 pages of reviews.

Meanwhile, Stripe has a Trustpilot score of 3.3, and Square has 4.6.

Most businesses will struggle with customer service at some point. But what accounts for PayPal’s troubling reputation?

The biggest complaint among users seems to be the inability to get in touch with a real person who is empowered to actually fix the problem. For online sellers, speedy resolution is a must. But if your only option is to submit a ticket and wait patiently, it is easy to get frustrated.

Inconsistent Security

PayPal has a decent number of security measures in place to prevent fraudulent purchases and accounts. The problem, however, seems to be consistency in applying these measures.

Online sellers are often frustrated by disputes from customers who paid with PayPal. Because of PayPal’s customer protection policies, the merchant could easily be left with nothing after a very hefty sale.

On the other hand, PayPal’s security often fails when it is needed most. One user, for example, tells the tale of two fraudulent checking accounts being attached to his PayPal even though he had two-factor authentication set up. Adding insult to injury was his inability to contact a live customer support agent during what was obviously an emergency situation.

High Processing Fees

PayPal is considerably more expensive than a lot of other online payment processors. In Australia, domestic transactions cost you 2.6% plus a flat $0.30 AUD. If you have international customers, expect to pay an extra 1%.

Compared to an alternative like eWay, which charges 1.5% + $0.25 whether domestic or international, PayPal fees can really add up. It might not seem like a lot, but if you are processing thousands of orders a year, that extra 1.1 percent is significantly eating into your profit.

Is There A Better Payment System Than PayPal?

Let us share the story of one client in our portfolio who will without a doubt say “yes!”…

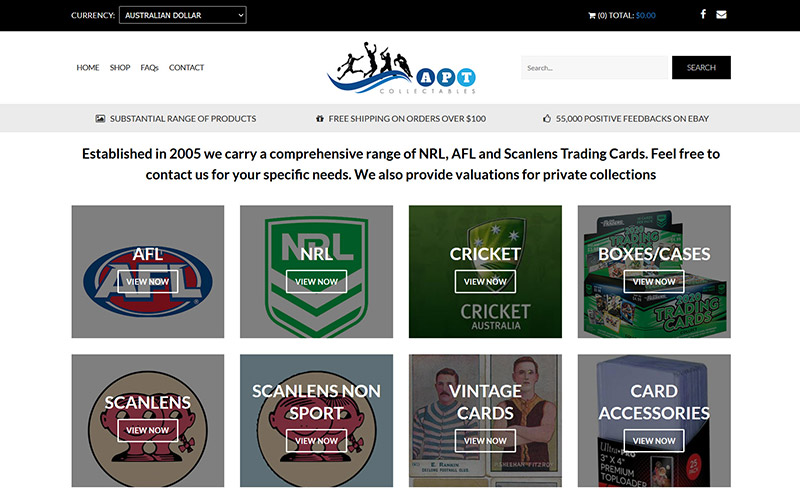

Established eBay trading card business APT Collectables approached Masters of Digital in hopes of creating an online store that was 100% under their own control.

Creating a streamlined e-commerce store to list more than 46,000 items was quite the project, and finding a workable payment processing solution was one of the biggest pieces of the puzzle.

Previously, APT Collectables had been using PayPal combined with Afterpay (for customers who wanted to pay in installments). However, the total combined fees were sometimes eating away as much as 20% of the sales price.

We set the new store up with Square, a common PayPal alternative for Australian online stores with only a 2.2% transaction fee. The results?

- 50% of APT’s previous PayPal customers paid by credit card instead

- 70% of APT’s previous Afterpay customers paid by credit card instead

That change was almost immediate after implementing the new payment solution. Furthermore, the owner of APT Collectables reported to us that they made back their investment on the new website in just 2 weeks simply based on what they saved in payment processing fees.

What Online Payment System Is Best?

The best payment processor for you will vary based on your exact needs. We compiled the following list by weighing criteria such as processing fees, international transaction charges, online vs brick-and-mortar stores, security and fraud protection, payment methods, and more.

Also included on the list are Afterpay and ZipPay. These aren’t actually payment gateways. Instead, they integrate with your payment solution in order to allow customers to pay in installments.

Here is our summary followed by in-depth reviews of each solution:

- Stripe: Most customisable PayPal alternative.

- Square: Best PayPal alternative for brick-and-mortar stores.

- eWay: Lowest fees.

- SecurePay: Most secure alternative to PayPal.

- Braintree: Largest assortment of payment methods.

- Afterpay: Best buy now, pay later solution.

- ZipPay: Best Afterpay alternative.

Stripe

A highly customisable PayPal alternative if you have a developer to work with.

Fee Summary

Domestic: 1.75% + $0.30

International: 2.9% + $0.30

These are the fees for credit cards. Different fees apply for bank transfers and other payment methods.

Pros

- Integrates with a large assortment of online stores.

- Highly customisable developer API.

Cons

- Not ideal for in-person sales.

Stripe has quickly gained fame as one of the most widespread payment processing solutions for online stores. They accept a range of payment methods in many global currencies. Stripe integrates easily with common online platforms like Shopify and WooCommerce.

In fact, Stripe is ideal for online stores because it does not have as much built-in functionality for point of sale transactions. For example, it doesn’t have the same inventory tracking capability of other options like Square.

Stripe is also highly customisable due to its open API and built-in developer tools. However, these features do require an in-depth knowledge of coding to capitalise on. Don’t let that scare you away, though. For the everyday user, Stripe is easy to use. There is just even more possibility for customising checkout flow and branding if you have a developer on hire. Stripe is an absolute favorite amongst WordPress developers for creating custom payment options to meet a clients need.

Square

A strong competitor to Stripe that works well for e-commerce and even better for brick-and-mortar.

Fee Summary

Online sales: 2.2%

In-person sales: 1.9% with Square Reader, 1.6% with Square Terminal or Register

Pros

- No extra fees for international sales.

- Low fees for in-person transactions.

Cons

- High percentage fee.

Square is a solid PayPal alternative for any Australian business. We rate it as the best choice for brick-and-mortar stores because they offer a wide range of card readers that you can use for point of sale transactions, including a free one that plugs right into your phone. Furthermore, Square’s transaction fees are significantly lower for in-person sales.

However, that doesn’t mean Square is only for brick-and-mortar stores. In fact, it works perfectly fine for e-commerce stores that operate solely online. If you have a lot of international customers, Square may be the ideal choice because there is no extra charge.

At 2.2%, Square does have a higher percentage fee than the leading competitor, Stripe, which charges 1.75%. However, Stripe also charges an extra flat $0.30 per transaction. So how do you decide which is right for you?

The flat fee of Stripe basically means that you will lose more if customers tend to make a lot of little purchases over time. But if your customers tend to make just one or two larger purchases, then Stripe’s fees may serve you better than Square.

This chart demonstrates the difference (assuming online domestic sales):

| Total Fees With Square | Total Fees With Stripe | |

| 1 purchase @ $500 | $11 | $9.05 |

| 10 purchases @ $50 | $11 | $11.75 |

So if your industry lends itself to lots of repeat transactions from customers, Square is probably the better choice.

eWay

The PayPal alternative with the lowest fees, meant for online stores only.

eWay is a promising competitor in the race for PayPal alternatives in Australia. Not only are they a local company founded here in Australia, but they are also a 3 time winner of Best Payments Provider at the National Online Retailers Association (NORA) Awards: 2018, 2019, and 2021.

The biggest selling point for many users is the low fees. At 1.5% + $0.25, they beat out any of the competitors who also charge a flat fee. However, keep in mind that these rates are only for Visa and Mastercard purchases. Another benefit of eWay is that there is no extra charge for international transactions, making them an ideal choice for online sellers with customers throughout the globe.

That does bring us to one of the downsides of eWay. They were developed as an online payment solution. If you do a lot of in-person business, they probably are not the choice for you. Some brick-and-mortar businesses have found success with eWay, though. For example, grocery stores can use it to accept online payments for delivery or pick-up orders.

Fee Summary

Visa or Mastercard: 1.5% + $0.25

Amex: 2.1% + $0.25

Pros

- An Australian business.

- Straightforward, low fees.

- Fast turnaround time on payments (1 – 3 days with approval).

Cons

- Does not support in-person payments.

- Cannot be customised as much as other options.

SecurePay

An Australian government enterprise with advanced fraud protection.

SecurePay is a payment gateway owned by Australia Post. Therefore, it is an easy choice if working with a federal government enterprise is important to you. Their rates are comparable to Stripe’s, and they also have an API that allows for developers to customise the user experience as much as you need.

As the name implies, information security is one of the chief selling points of SecurePay. Every account includes FraudGuard, their custom advanced fraud protection service. FraudGuard allows you to set rules, such as maximum purchase amounts, which will then be used to automatically screen purchases and notify you of suspicious activity.

You can even set specific preferences based on the country the purchase originates. Furthermore, for an additional $0.05 per transaction, you can enable 3DS2, the latest technology in customer authentication to help prevent credit card fraud that could cost you significantly.

Fee Summary

Domestic: 1.75% + $0.30

International: 2.9% + $0.30

Pros

- Owned by Australia Post, an Australian government business.

- Includes free FraudGuard: advanced fraud protection.

Cons

- Does not easily integrate with in-store payments

Braintree

A PayPal-owned gateway with a large assortment of payment methods.

Braintree was actually acquired by PayPal in 2013. So, if you are looking to completely distance yourself from anything PayPal related, it may not be the choice for you.

However, as a payment gateway, it still has a lot to offer for both online and in-store sellers. The primary reason to choose Braintree is if you are looking to offer customers a very wide range of payment methods. In addition to debit and credit cards, Braintree also accepts PayPal, Venmo, Apple Pay, Google Pay, and a host of other digital wallets and major bank transfers.

Another niche use of Braintree is collecting and disbursing payments for online marketplaces. If your website hosts individual sellers who work directly with their own customers, Braintree could be the right payment processor for you. In addition to their customisable API, Braintree also features specific integration for online marketplaces that make it easier to collect payments, mitigate fraud, and manage payouts.

Fee Summary

Domestic: 1.75% + $0.30

International: 3.9% + $0.30

Pros

- Accepts a wide-range of payment methods and currencies.

- Works with digital wallets like Apple Pay and Google Pay.

Cons

- Expensive international fees.

- Owned by PayPal.

- Not ideal for small businesses.

Afterpay

A seamless buy now, pay later solution.

Afterpay is a little different from the other PayPal alternatives we have looked at so far. It is not actually a payment gateway. Instead, Afterpay provides you an easy way to let customers pay in installments. Customers place the order on your website using Afterpay and you will receive payment in full a few days later (minus fees).

Buy now, pay later options like this are helpful for customers who might not have traditional means of buying on credit. For you, Afterpay helps increase conversions and total sales. Customers may be willing to spend more when they don’t have to have all of the cash on hand immediately.

One thing to keep in mind is that Afterpay’s fees are higher than a traditional payment gateway. If you choose to offer this solution for your customers, be sure to pay attention to how much it affects your revenue. Ideally, the increase in sales volume and cart totals should make up for the extra fees. But every industry is different.

Fee Summary

Estimated fee: 4 – 6% + $0.30

Afterpay doesn’t publish an exact fee, but many online sources confirm a range of 4 to 6 percent plus a $0.30 transaction fee. One client of ours reported that the combined fees of Afterpay and PayPal were taking almost 20% out of their profits.

Pros

- Integrates easily with Square.

- Convenient for customers.

Cons

- Fees can get quite high.

Zip Pay

The best Afterpay alternative.

Zip Pay is another buy now, pay later option if you are looking for something other than Afterpay.

Alternatively, you may just want to use both in order to give customers their choice of options. If a customer is used to using Zip Pay, after all, they might be more willing to purchase from you than a competitor that only offers Afterpay.

The two solutions are fairly comparable in fees and options for customers. Both provide interest free loans, though a late fee applies when payments are missed. Both require customers to pay back the loan in at most four installments over a short period of time.

The initial credit limit varies and may change based on a customer’s spending habits. Afterpay starts around $600 and Zip Pay at a range of $350 – $1000.

Effectively, these differences don’t mean much to you, the merchant. But they can be helpful if you want a better understanding of how your customers will be spending.

Fee Summary

Estimated Fee: 5% + $0.30

Like Afterpay, ZipPay does not publish clear fees. These are our best estimates based on third party reports.

Pros

- Opens you up to more customers.

Cons

- More variable starting credit limits than Afterpay.

Looking For Professional Help Switching To a PayPal Alternative?

Masters of Digital helps businesses in Australia build quality, secure e-commerce websites. We have worked with everything from Shopify to WooCommerce using a wide variety of payment gateways in plenty of industries.

If you are ready to find an alternative to PayPal for your business, we can make the transition smooth and hassle free. Learn more about our e-commerce website design process or contact Masters of Digital today to talk to a professional about finding the solution that’s right for you.